Scaling AI Operations in Recent Fintech Architecture

Executive Summary

"How we helped a leading fintech startup reduce transaction processing time by 40% using automated workflow orchestration."

— Essential reading for leaders in technology and operations.

The Challenge

Modern fintech infrastructure requires split-second decision making. Our client was facing a bottleneck in their manual review process for high-value transactions.

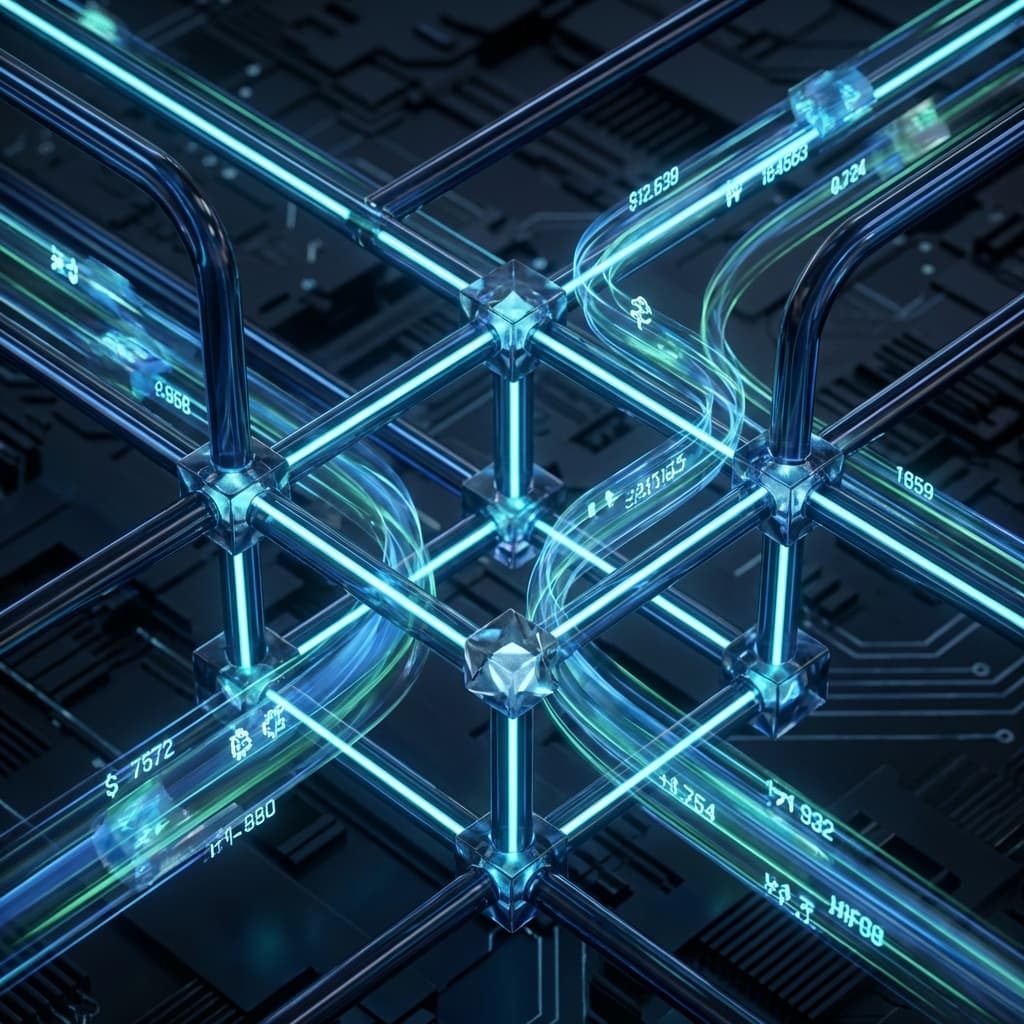

The Solution

We implemented a custom AI orchestration layer that pre-validates transactions against 40+ risk parameters before they ever reach a human reviewer.

Key Components

Event-Driven Architecture: Utilizing Kafka for real-time data ingestion.

ML Risk Scoring: Custom models trained on historical fraud patterns.

Human-in-the-Loop: Seamless handoff interface for edge cases.

Results

40% reduction in processing time.

99.9% uptime during peak trading hours.

Zero increase in false positives.

Written by Hassan Rehman

Head of Product

Specializing in high-performance architecture and AI systems. Committed to building the next generation of digital infrastructure.